Who knew high voltage cables running for kilometers in a deep electrolytic moving body of water would be expensive?

The 245kV Wolfe Island Cable | Photo by Z22

Despite offshore windfarms dealing in a kind of mechanical hell of high-speed salt water spray, big waves, and volatile wind conditions, surprisingly 85% of the insurance claims are because the underwater cables are failing.* If the subsea cables can’t be insured, it’s another unexpected cost threatening the economics of offshore wind.

The underwater cables needed for offshore wind are apparently so costly to repair, and the losses from lack of generation are so steep, that they are in danger of becoming uninsurable.

Subsea cable failures pose global threat to offshore wind

Energy News Live

The race to harness offshore wind energy has hit a significant roadblock, with the reliability of subsea cables emerging as a critical concern.

Global Underwater Hub (GUH) has raised alarm bells about the escalating issue of subsea cable failures.

These setbacks not only disrupt power transmission but also incur hefty costs.

Imagine if an entire coal plant was connected to the grid through one long cable buried under the ocean, and when the cable failed, it took months to find and repair — during which time the plant could not earn a cent…

Subsea cable failure could derail global offshore wind projects

World Oil

GUH chief executive Neil Gordon, said, “It’s estimated that around 85% of the total value of offshore wind insurance claims relate to subsea cables. Insurers are losing money underwriting cables, with the average settlement claim in the region of £9 million. Brokers have warned that the high number of cable claims is affecting capacity and coverage, and the cost of repairs typically runs into millions, with warranties rarely covering the high cost of business interruption.

“If these critical components become uninsurable, offshore wind projects around the world will be derailed, making global 2050 net zero targets completely unachievable.”

According to one developer, the cost of insuring a 1.2GW offshore wind farm over its lifetime is in the region of £350 million, and insurance brokers estimate that the costs of floating offshore wind will be 30% higher than fixed bottom ones.

Global Power Marine fixes export cables and quotes one happy customer talking about needing “only” 32 days instead of 67 days to repair the cable. But all the while, part or all of the wind plant isn’t earning any income, and so much of any repair depends on getting good weather so a ship can hover and work uninterrupted while the cable is “dangling” and exposed.

Gulski et al. estimate the duration of failure can be 1 to 3 or even up to 9 months:

“Last 20 years of experience shows that the power cables are the largest contributor to the failures of power supply from the offshore plants. “

From Gulski et al.

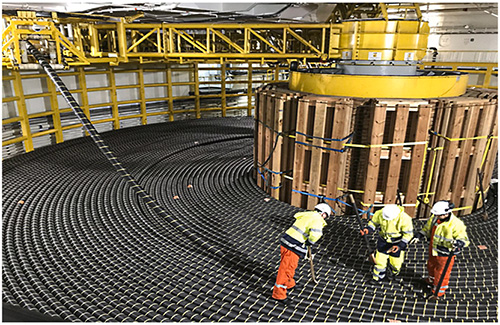

For those who want the details on the challenges of engineering, Gulski et al. detail some of the problems with subsea cables like the need for armour that isn’t magnetic, sections that are 30-50 kilometers long to avoid “joints” underwater, and why most cables on the sea floor are called “wet structures” which allow water in (at least to the outer layers).

Wind energy might be free, but collecting it costs the Earth.

Late Update — Australia desperately needs to learn these lessons

Prompted by comments from David Maddison and Ross below:

There are no offshore wind plants in Australia, but we are rushing to build them, so the tales of woe from the UK and US are especially relevant here now.

The Basslink Cable from Tasmania to mainland Australia has broken not once, but three times here in the last seven years. First, in 2016, for 5 or 6 months (I believe Australia didn’t even have the right repair ship; we used the Ile De Re, which was based in Jakarta). Then, the cable was out again in 2018 for two months. And in 2019, for another month due to a problem on land at the Victorian end.

The Basslink repair in 2016 was delayed for weeks because of bad weather.

After three weeks of delay, the ship was finally able to leave Geelong last night and the repair team hopes calm conditions will last long enough to connect a new section of cable to the existing one. The repair team needs 16 calm days to work on the cable before it can be up and running again.

How could our BOM even predict 16 calm days on the Bass Strait…?

_______________

*Admittedly, this percentage may be high because insurance companies don’t cover most of the other kinds of failures on wind “farms”, as we see with Siemens’s massive stock loss as they realized the true cost of maintenance.