Adjusted for today’s dollars the Second World War cost $4.1 trillion. On March 11, 2021 the United States committed to spend nearly half of that.

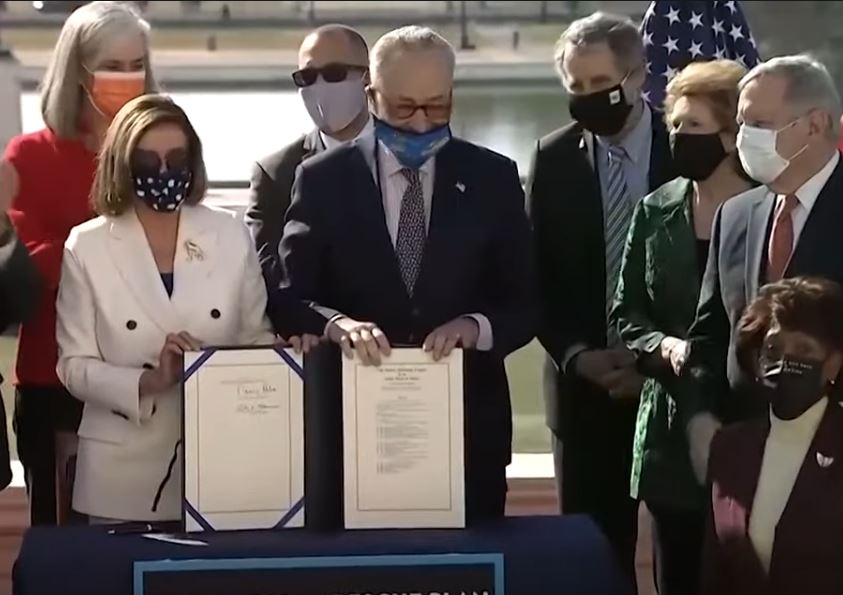

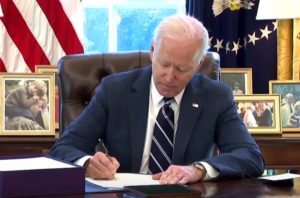

American Rescue Plan Act of 2021

Signed into law 03/11/2021

Passed Senate 03/06/2021

Congressional Summary

This bill provides additional relief to address the continued impact of COVID-19 (i.e., coronavirus disease 2019) on the economy, public health, state and local governments, individuals, and businesses.

Specifically, the bill provides funding for

- agriculture and nutrition programs, including the Supplemental Nutrition Assistance Program (SNAP, formerly known as the food stamp program);

- schools and institutions of higher education;

- child care and programs for older Americans and their families;

- COVID-19 vaccinations, testing, treatment, and prevention;

- mental health and substance-use disorder services;

- emergency rental assistance, homeowner assistance, and other housing programs;

- payments to state, local, tribal, and territorial governments for economic relief;

- multiemployer pension plans;

- small business assistance, including specific programs for restaurants and live venues;

- programs for health care workers, transportation workers, federal employees, veterans, and other targeted populations;

- international and humanitarian responses;

- tribal government services;

- scientific research and development;

- state, territorial, and tribal capital projects that enable work, education, and health monitoring in response to COVID-19; and

- health care providers in rural areas.

The bill also includes provisions that

- extend unemployment benefits and related services;

- make up to $10,200 of 2020 unemployment compensation tax-free;

- make student loan forgiveness tax-free through 2025;

- provide a maximum recovery rebate of $1,400 per eligible individual;

- expand and otherwise modify certain tax credits, including the child tax credit and the earned income tax credit;

- provide premium assistance for certain health insurance coverage; and

- require coverage, without cost-sharing, of COVID-19 vaccines and treatment under Medicaid and the Children’s Health Insurance Program (CHIP).

_______

_______

Deficit Impact approximately $1.9 trillion

A breakdown of the deficit impact of the law compiled by the Committee For a Responsible Budget. A few provisions were tweaked prior to passage such as the elimination of the $15 minimum wage by the Senate Parliamentarian.

| Policy | Deficit impact, 2021-2031 |

|---|---|

| Ways & Means | $923 billion |

| Provide $1,400-per-person stimulus checks | $422 billion |

| Extend unemployment programs through August 29 with a $400/week supplement | $246 billion |

| Expand Child Tax Credit, Child Care Tax Credit, and Earned Income Tax Credit mostly for one year | $143 billion |

| Provide grants to multi-employer pension plans and change single-employer pension funding rules | $58 billion |

| Temporarily expand ACA subsidies for two years and subsidize 2020 and 2021 coverage | $45 billion |

| Extend paid sick leave and employee retention credit | $14 billion |

| Subsidize COBRA coverage for laid-off workers* | $8 billion |

| Repeal rule allowing multinational corporations to calculate their interest expenses including foreign subsidiaries | -$22 billion |

| Other policies | $9 billion |

| Oversight & Reform | $350 billion |

| Provide money to state governments | $195 billion |

| Provide money to local governments, territories, and tribes | $155 billion |

| Create paid COVID leave for federal workers and other policies | $0.4 billion |

| Education & Labor | $290 billion |

| Provide funding for K-12 education | $129 billion |

| Provide funding for colleges and universities | $40 billion |

| Provide support for child care, grants to child care providers, and Head Start | $40 billion |

| Subsidize COBRA coverage for laid-off workers* | $10 billion |

| Extend nutrition assistance in place of school lunch for the duration of the emergency and other food assistance | $7 billion |

| Human services, labor programs, and other policies* | $11 billion |

| Energy & Commerce | $122 billion |

| Increase funding for testing and contract tracing | $50 billion |

| Increase public health workforce and investments | $19 billion |

| Fund vaccine distribution, confidence, and supply chains | $16 billion |

| Increase Medicaid payments to states that newly expand Medicaid under the ACA | $16 billion |

| Allow states to expand Medicaid coverage for prisoners close to release and for pregnant and postpartum women for 5 years | $9 billion |

| Remove the cap limiting how much drug manufacturers must rebate to Medicaid for drugs that have increased quickly in price | -$18 billion |

| Other policies* | $31 billion |

| Transportation & Infrastructure | $90 billion |

| Increase funding for the Disaster Relief Fund and cover funeral expenses related to COVID | $47 billion |

| Provide grants to transit agencies | $28 billion |

| Provide grants to airports and aviation manufacturers | $11 billion |

| Provide grants to communities under economic stress | $3 billion |

| Grants to Amtrak and other transportation-related spending | $2 billion |

| Financial Services | $71 billion |

| Provide emergency rental assistance and assist homeless | $30 billion |

| Provide grants to airlines and contractors to freeze airline layoffs through September | $12 billion |

| Use Defense Production Act to buy and distribute medical supplies | $10 billion |

| Provide mortgage payment assistance | $10 billion |

| Reauthorize and fund the State Small Business Credit Initiative | $9 billion |

| Small Business | $50 billion |

| Provide grants to restaurants and bars that lost revenue due to the pandemic | $25 billion |

| Provide additional EIDL Advance grants of up to $10,000 per business | $15 billion |

| Allow more PPP loans and expand eligibility to certain non-profit and digital media companies | $7 billion |

| Other policies | $3 billion |

| Veterans’ Affairs | $17 billion |

| Provide funding for health care services, facilities, and copays for veterans | $16 billion |

| Fund job training assistance programs for veterans and other VA administrative costs | $1 billion |

| Agriculture | $16 billion |

| Increase nutrition assistance | $6 billion |

| Pay off loans and other programs for socially disadvantaged farmers | $5 billion |

| Purchase and distribute food to needy individuals | $4 billion |

| Testing and monitoring for COVID in rural communities and among animal populations | $1 billion |

| Foreign Affairs (no legislation reported yet) | $10 billion |

| Natural Resources (no legislation reported yet) | $1 billion |

| Science, Space, & Technology (no legislation reported yet) | $1 billion |

| Total* | $1.927 trillion |

Source: CRFB calculations from Congressional Budget Office and House Budget Committee documents

This table shows the deficit impact of various provisions, which may differ slightly from the total amount of aid offered. For instance, $50 billion is allocated to the Disaster Relief Fund, but CBO estimates that only $47 billion will ultimately be spent, based on past precedent. As another example, there are $15 billion in loans and grants given to airlines, but the previous version of this bill has led CBO to conclude that $3 billion will ultimately be repaid or given to the government as stock as a condition of accepting the support.

*The total removes $14 billion from COBRA subsidies and funding for LIHEAP that are shared between two committees and would be double-counted if summing each committee’s total.